DON'T PANIC

Jun 22, 2022DON’T PANIC!

According to Douglas Adams, the Hitchhiker's Guide to the Galaxy outsold the Encyclopaedia Galactica because it had the words 'DON'T PANIC' on its cover. Arthur C Clarke thought these words were the best advice for humanity. And they are the best advice for start-up founders today.

In a few short months the bull market, where every kind of tech asset attracted investment and ever larger valuation, was tamed. For the foreseeable future we will have to live with a bear market, where tech stocks struggle to recover their value after their recent peaks. Few will.

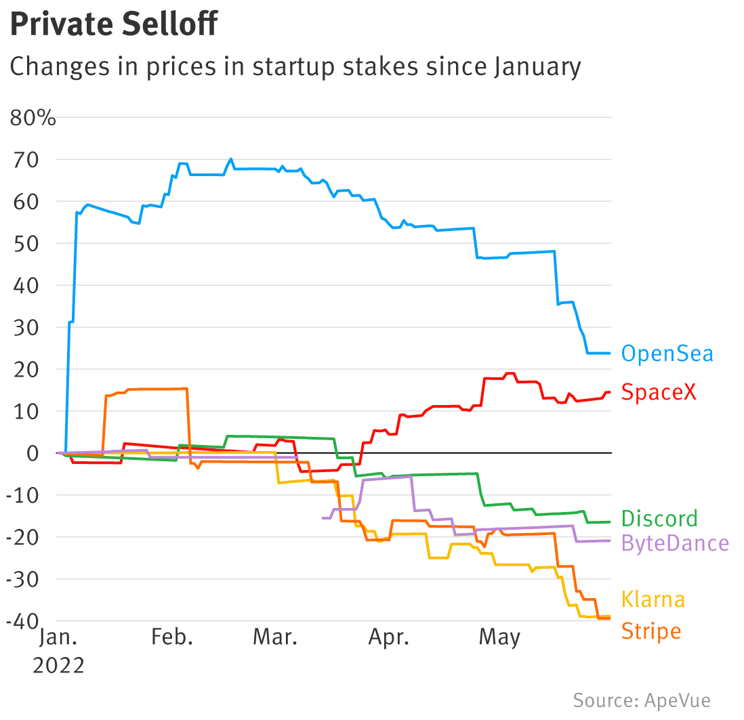

Many of the recent tech stars have seen humiliating drops in their stock price, with only Space X managing to stay in orbit. Klarna’s credit with investors is running out, as its stock has fallen by a third.

Source: The Information

Source: The Information

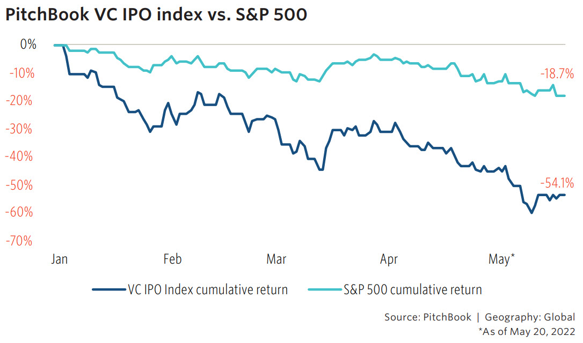

According to Pitchbook, more than 140 VC-backed companies that went public in America since 2020 have market capitalizations that are less than the funding they raised over their lifetime.

IPO returns, which out-stripped the rest of the stock market, have dived despite eye-watering VC investment over recent years:

Source: Pitchbook

The global rate of Unicorn birth has halved 50% since Q2 2021 (CB Insight).

Certain sectors, such as Insurtech, are slumping (CB Insight).

Valuations are down up to 30% (Pitchbook).

UK tech job vacancies are down 20% over the last 3 months, with small start-ups and those employing over 1,000 showing the biggest drops, of a third. (Sifted)

The misery index, which is the unemployment rate added to the rate of inflation, is growing, although we are still some way from the covid peak of 2020, or the mullet-induced nadir of 1980.

What does this mean for founders?

It depends on your situation…

If you are running an over-valued, growth-chasing start-up and quickly burning through your hoard of investor gold, then you are in the greatest peril and facing a case of So Long, And Thanks for All the Fish. Act radically in your battle for survival.

If you have funding but are in better shape, because you are generating revenue and costs are under control, then it is all about runway. Can you lengthen yours to survive this market readjustment? Cut any cost you can without destroying the customer experience.

If you are an early stage founder, there is no reason to despair or hit the panic button. It may even be a good thing:

- As Oscar Wilde said, ‘we are all in the gutter, but some of us are looking at the stars.’ There is always opportunity in a crisis. You need to find it. Millions of customers will be changing their behaviour as they look to do more with less. Can you meet that demand?

- Many VCs have suffered because unrealized returns were at an all-time high. Their ledgers have been battered. But others cashed out early and will have money to invest. There is still significant sums of dry powder in the market. There are also several mega-rich founders who realised sky-high returns on their equity. All of them will be looking to pick up equity while it is cheap, getting better value than recent months.

- Markets have always punished bad companies and rewarded good ones. Fantasy valuations and unrealistic bets don’t really help anyone in the longer-term. This downturn will force founders to make sure their businesses are built to last, rooted on solid foundations, such as a decent business model and a chance of becoming profitable. This is your best way of attracting cash.

- Very early stage businesses are the least likely to be affected, as their share of the investment pie was already dwindling:

Source: Tech Nation

Investors, especially Angels, will still be looking for the next big thing. They may look for slightly different things and favour the sectors that they know best and safer bets, such as B2B or businesses with a shorter path to profitability.

Continuing geo-political instability means this new economic reality is likely to endure for several years to come. So the sooner you, your teams and your business adjust to it, the better. See the analysis and advice Sequoia shared recently here.

If you see this downturn as an opportunity and adjust your thinking and your plans, then you may still win big enough to dine at The Restaurant at the End of the Universe.

----

UP AND TO THE RIGHT helps early stage founders beat the odds by offering playbooks, tools and advice to help them anticipate and solve problems like successful entrepreneurs. Get your business into better shape for fundraising and surviving the new economic reality here.